In the Netherlands, as in other EU countries, there is an obligation to notify the posting of employees. Failure to comply with this obligation results in negative consequences – both for the posting employer and the counterparty to which the workers are seconded. Therefore, it’s extremely important to know how to properly make the application.

1. Notification obligation

The notification obligation is incumbent on foreign entrepreneurs sending employees to work in the Netherlands. Therefore, the duty in question is imposed on entrepreneurs posting workers in the connection with the execution of concluded contracts, temporary-work agencies, enterprises seconding employees as part of a consortium.

Applicattion should also be made by self-employed who work in the following industries:

- agriculture and related service activities;

- horticulture,

- food industry,

- industrial processing,

- construction,

- road transport of goods, unless it consists solely in the road freight transport through the Netherlands without loading or unloading in this country,

- accomodation and food service activities,

- cleaning,

- care activities.

In the event of a change in the data contained in the declaration (e.g. early return of workers), it’s necessary to update the notification.

2.Web portal

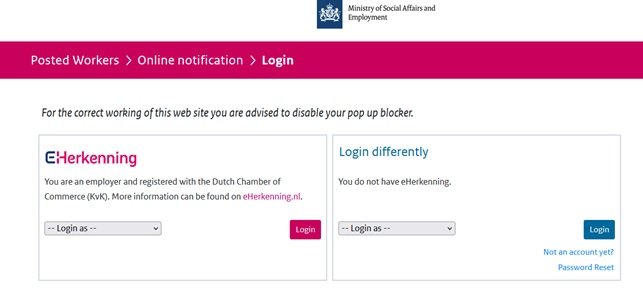

The application should be made via the dedicated internet portal. There is a direct link to the official notification portal on the website https://www.postedworkers.nl/ . The portal is also available at: https://meldloket.postedworkers.nl/runtime/?lang=en .

The notification portal is available in several languages: Dutch, German and English.

3. Data required for notification

To make a notification, it’s necessary to create an account. The account also allows to check the status of current applications, update them and view archival notifications.

The notification takes place by filling in a special form. For this purpose, it’s necessary to have the following information:

- Information on the posting entity:

- Details of the posting entity – company name, its address, country where the head office is located, commercial register number, VAT number;

- Data of the legal representative of the posting entity – first name and surname, date of birth, nationality of the representative, identification number in the country of origin (in Poland PESEL number), Dutch Citizen Service Number (so-called BSN) – if the person has it, telephone number, e-mail address;

- Details of the contact person representing the posting employer in the Netherlands – first name and surname, date of birth, nationality of the representative, identification number in the country of origin, Dutch Citizen Service Number (so-called BSN) – if the person has it, telephone number, e-mail address and address where this person stays in the Netherlands;

- Customer data – company name, address, country where the head office is located, commercial register number, VAT number, first name and surname of the person representing the Customer, Customer’s telephone number and Customer’s e-mail address;

- Information concerning the contract implemented in the Netherlands – sector, subsector and SBI code, exact address of the place where the work is carried out, start and end date of the work, identification of the company paying the remuneration;

- • Details of workers posted to the Netherlands – first name and surname, date of birth, nationality, identification number in the country of origin, Dutch Citizen Service Number (so-called BSN) – if the person has one, nationality of the employee, if the worker comes from a country outside the EU and EEA, it’s necessary to indicate until when the document entitling to stay is valid, determination whether the worker has an A1 certificate, the number of the A1 certificate and the country in which the attestation in question was issued.

4. Confirmation of notification by the customer

The customer’s telephone number and e-mail address constitute a very important piece of information provided on the application form. Indeed, the e-mail address in question will receive a request to check and confirm the notification made by the posting employer. If the client fails to do so, the declaration will be invalid.

The customer is also obliged to check and confirm any changes to the application.

5. Sanctions

Failure to comply with the notification obligation is punishable by a fine. It’s imposed both on the employer sending the worker abroad/self-employed and on the customer. For example: the fine for failure to declare up to 9 workers is EUR 1,500.00, and from 10 to 19 employees – EUR 3,000.

6. Legal notice

The study is a work within the meaning of the Act of 4 February 1994 on Copyright and Related Rights (OJ 2006, No. 90, item 631, consolidated text, as amended). Publishing or reproducing this study or its part, quoting opinions, as well as disseminating in any other way the information contained therein without the written consent of Crede sp. z o.o. is prohibited.