In France, every employer is obliged to issue a pay slip (Bulletin de salaire/Fiche de paie/Bulletin de paie/Bulletin de paie clarifié) to a worker. Legal provisions strictly define what such a document should contain and what information can’t be included on it. In practice, these wage slips are created according to a scheme and thanks to that, there are very similar to each other. This allowed to prepare a short guide designed to “decipher” salary slip.

1.General information

A payslip constitutes a document indicating the amount of the remuneration obtained by an employee for work. French legislation imposes an obligation on each employer to deliver it to employees once a month, on the occasion of payment of salaries. The failure to comply with the obligation in question is punishable by a fine of €450.00 per document.

The employee should keep all payslips throughout life. If the document is lost, there may be a problem with obtaining a duplicate. The employer doesn’t have a legal obligation to issue it.

At this point, it should be noted that the employer has an obligation to keep the issued salary slip only for a period of 5 years.

Since 2017, the wage slip has been issued in electronic form. The worker can print it in accordance with the instruction given by the employer. A paper pay slip may only be issued by the employer with the consent of the employee. Only at the worker’s explicit request, the employer may give him/her such a document in paper form.

2. Information that can’t be included on the salary slip

It’s forbidden to include information about the employee’s right to strike on the French payslip. The salary slip also can’t mention that the employee fulfils the function of workers’ representative in the workplace. Information concerning the remuneration for performing the above-mentioned function should be included in a separate document that the employer should give to the employee.

3. Structure of the pay slip

The French payslip is composed of several parts:

- the part concerning the employee;

- the part concerning the employer;

- the section containing information on contributions paid by the employer and by the employee;

- the summary.

Below, we will discuss the different parts of the French payslip.

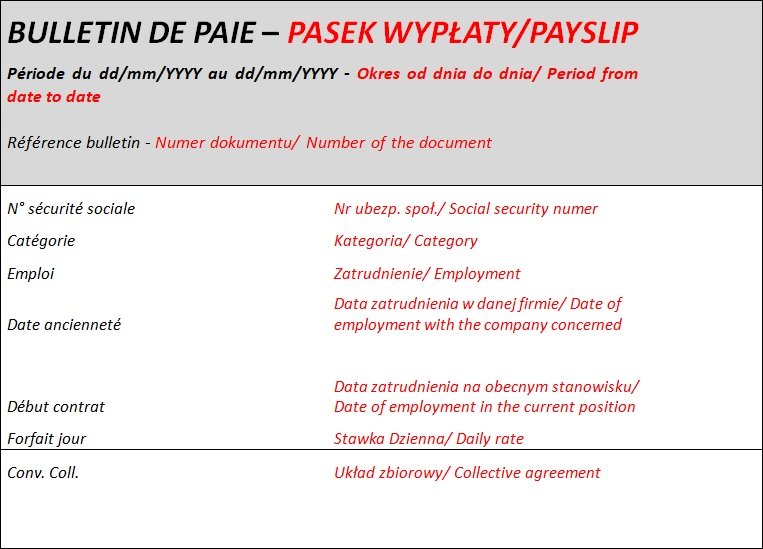

3.1 Information concerning the employee

The section of the salary slip relating to the employee contains the following data:

- Période / Period – the period for which the payment is due;

- Référence bulletin – the number of the document;

- Numéro sécurité sociale (N˚ sécurité sociale, N˚ S.S.) – the employee’s social security number;

- Catégorie /Coefficent – the worker’s grade; the employees’ category is determined in accordance with the collective agreement applicable at the workplace. It usually takes the following division:

- I for unskilled workers,

- II for medium skilled employees,

- III for the most qualified workers;

- Emploi- the position occupied by the employee;

- Ancienneté – seniority;

- Matricule – the individual employee number (also known as HR number);

- Date d’entrée (Début contrat)/ Entrée – the date of start of work (the obligation to include this information on the pay slip is optional);

- Conv. Coll (convention collective) – information on the collective agreement in force at the workplace.

* The attached graphics are illustrative and may differ from the payslips issued by individual employers.

3.2 Information concerning the employer

The next part of the salary slip contains information related to the employer. This include:

- ENTREPRISE – identification of the employer, i.e. name and determination of the legal form;

- Adresse – full address;

- CP Ville – postal code;

- SIRET – SIRET number;

- NAF/APE – equivalent of the Polish PKD (Polska Klasyfikacja działalności – Polish Classification of Activities).

* The attached graphics are illustrative and may differ from the payslips issued by individual employers.

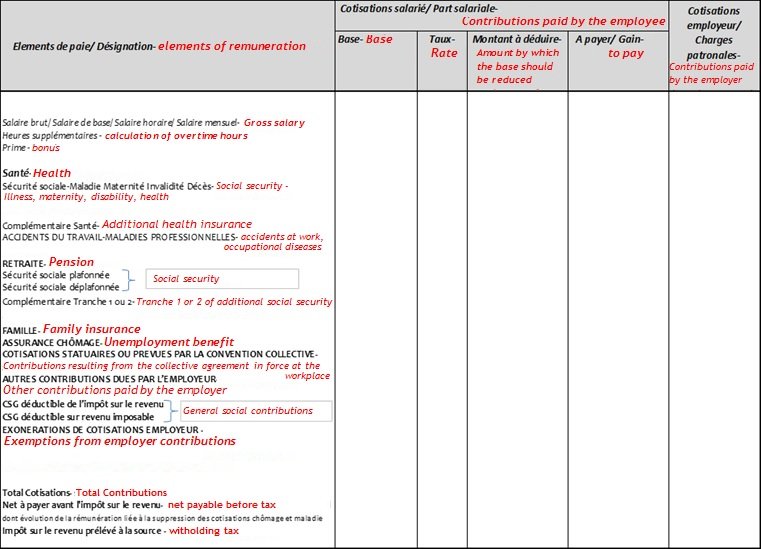

3.3 Information on contributions paid by the employer and by the employee

This part of the salary slip is the most extensive. It contains information on social and health contributions paid by the employee and the employer. This data is presented in a table in which we can distinguish the following sections:

- Section I – it contains information on gross salary;

- Section II – it includes information on health contributions and accidents at work;

- Section III – it includes information on pension, family, unemployment contributions, resulting from collective agreements and paid in full or in part by the employer – it should be pointed out that contribution amounts indicated on the salary slip are calculated on the basis of the applicable percentage rates.

* The attached graphics are illustrative and may differ from the payslips issued by individual employers.

This part of the payslip may also contain additional information concerning, for example:

- congé payé/CP – holiday leave compensation;

- avantages en nature – information on benefits in kind, e.g.:

- panier de repas – meal financing;

- avantage logement – accomodation paid by the employer

When reading the salary slip, it should be remembered that the hours actually worked constitute the basis for calculating the remuneration due to the employee. The monthly standard of working time is determined taking into account the 35-hour working week applicable in France. It’s calculated as follows:

35h/week x 52 weeks a year

___________________________________________________ = 151,67h a month

12 months

For example: According to the content of the employment contract, the employee is entitled to a gross salary of € 18.00 for each hour worked. For example: According to the content of the employment contract, the employee is entitled to a gross salary of € 18.00 for each hour worked.

| Number of hours (“base” column) | x | Gross hourly rate (“Taux” column) | = | Gross monthly salary (“A payer” column) |

| 151,67(“base” column ) | x | € 18,00 (“Taux” column) | = | € 2730,06 gross per month (“A payer” collumn) |

Depending on the circumstances, the “A payer/Gain” column may also show information concerning the amount of bonuses, benefits in kind, payments for overtime, holidays, etc. received by the worker.

From 1 July 2023, in order to allow beneficiaires of social benefits to understand which remuneration components are taken into account when calculating social benefits, employers will be obliged to include the MNS indicator on salary slips. This is the net social amount after deduction of all compulsory social security contributions.

3.4 Summary

At the end of the salary slip, there is a summary of the components of the remuneration. It includes information for both the current month and the entire calendar year.

The most important information for the worker in this section of the salary slip is the sum under the ‘”NET A PAYER” box. This is the amount that the employer should pay.

There is also very important data in the columns:

- Total versé – the amount of remuneration earned during the year;

- Ch. Patronales – the costs incurred by the employer in the connection with the engagement of an employee for a period of one month (Mensuel) and on a yearly basis (Annuel).

* The attached graphics are illustrative and may differ from the payslips issued by individual employers.

The summary also contain information related to holidays:

- the yellow field shows the number of used leave days;

- the green field indicates the amount of leave remaining to be taken;

- the red field shows the amount of paid annual leave to which the employee is entitled;

- the blue fields contain the dates (from day to day) on which the worker has taken annual leave.

4. Novelties introduced in 2022

From January 2022, the “Income Taxes” block contains, in addition to data concerning witholding tax (PAS), information on the amount of taxable net salary and on the tax-free overtime remuneration. An indication of the “annual total” is also placed next to each of these elements. This is the sum of the values appearing on the salary slips already sent by the employer for the previous months of the year in question.

Moreover, from 2022, the salary slip only mentions the rate. There should be no reference to a “personalised” or “non-personalised” PAS rate in the payslip.

The salary slip should contain sections “Net payable before tax” and “Net payable to the employee”. Since last year, these headings and the associated amounts should be shown on the payslip in such a way as to facilitate readability compared to the other lines.

Since last year, these headings and the associated amounts should be shown on the payslip in such a way as to facilitate readability compared to the other lines.

It should be noted that the line “Reduction of employer’s contribution” was removed from the salary slip template published on 30 December 2021. Such a change was temporary. This line returned to the payslip template published on 22 January 2022.

5. Legal notice

The study is a work within the meaning of the Act of 4 February 1994 on Copyright and Related Rights (OJ 2006, No. 90, item 631, consolidated text, as amended). Publishing or reproducing this study or its part, quoting opinions, as well as disseminating in any other way the information contained therein without the written consent of Crede sp. z o.o. is prohibited.